Alpha Athletika in Montreal’s Saint Leonard neighbourhood is like any other gym.

They post silly, gym-specific videos and share workout tips on their social media accounts. They’ve got most of the equipment any dedicated lifter could hope to use. They host events, such as barbecues and competitions, for their diverse community of members.

But the familiar walls and equipment of Alpha Athletika, entirely unbeknownst to its owners, have also shown up somewhere much darker.

The Tyee has learned this gym is where the white nationalist group Frontenac Active Club and its members have repeatedly trained.

Images posted to the club’s Telegram channel show its members posing for propaganda pictures in the gym, with huge flags unfurled and Nazi imagery on at least one member’s workout clothes.

This discovery set The Tyee on a path that unveiled the identity of a member of the group.

A visual investigation completed by The Tyee and an extremism researcher exposed the man behind one of the blurred faces in the Frontenac Active Club propaganda photos. He appears to be former Olympian Giulio Zardo, who was working as a boxing coach at Alpha Athletika.

When the Tyee told Alpha Athletika’s ownership about the white nationalists gathering at their gym, they were horrified and shocked. These Frontenac Active Club gatherings happened outside of normal hours, and their true nature was entirely unknown to the owners of the gym.

In an emailed statement, the owner told The Tyee the gym has taken immediate action to ensure their gym remains a welcoming space for the community.

“We were recently made aware that a coach who had access to our facility conducted private, after-hours training sessions with individuals affiliated with a group whose views do not align with our values. These sessions were organized independently and without our knowledge or authorization as official gym programming,” Alpha Athletika told the Tyee over email.

“Once informed, we immediately addressed the situation and have ended our relationship with the coach. We are reviewing and strengthening our facility use policies to ensure clearer oversight moving forward. Our gym is built on inclusivity, respect and community. We do not condone extremism or divisive ideologies in any form.”

Alpha Athletika is just the latest gym to find itself in the unsettling position of having to respond to revelations that white nationalists have moved in, and it responded much more quickly than some others.

A different Montreal-area gym made headlines in January after a man wore a Nazi symbol into their facility. The gym initially told the man not to wear the item anymore, stopping short of permanently cancelling the man’s membership. Following public outcry and reporting from CTV News, the man was then permanently banned from the gym.

A CBC investigation also revealed active clubs had been training in martial arts clubs and gyms in Hamilton, Ontario.

According to Canadian Anti-Hate Network’s Elizabeth Simons, “it’s not surprising if some people can’t clock those symbols for what they are.”

That said, it’s the responsibility of any “unsympathetic gym,” which “values diverse clientele and denounces extremism,” to know these signs and “shut it down” when people who boast them show up, Simons said.

“It’s sort of like that Nazi bar anecdote from a few years ago. If a guy shows up wearing a totenkopf or with questionable tattoos or something and doesn’t get any pushback, he’ll bring friends,” Simons said.

“And then they will bring friends. And pretty soon you’re running a gym that Nazis know they can use without issues, and they’ll start filming their propaganda there, and then you’ve got a problem.”

Simons said gym owners, coaches and trainers “all need to really take an interest in stamping it out when it shows up in their spaces.”

That’s exactly what Alpha Athletika said it intends to do. The owner made it clear to The Tyee that they wouldn’t be waiting for public outcry to take action. They repeatedly reiterated their shock and concern about the situation, affirming that they intended to address this issue immediately and comprehensively.

Photos from Frontenac Active Club’s Telegram channel show members of the group training inside a gym The Tyee has identified as Alpha Athletika in Montreal.

Photos via Telegram.

The rise of fascist fight clubs in Canada

Frontenac Active Club is a part of a growing phenomenon in Canada, the U.S. and Europe. Active clubs are groups of white nationalist extremists who gather in person to work out and practice smacking each other around — all in the name of preparing for impending violence.

The rise of active clubs in Canada is no joke, warned Simons.

“In Canada, three men associated with (active clubs) have been charged with terrorism offences: one was found guilty and is serving 10 years in prison, one pleaded guilty and is awaiting sentencing and the third is awaiting trial. Outside Canada, active club members have been responsible for violence in several countries,” Simons explained. (These examples of criminal charges and violence do not involve Frontenac Active Club or its members.)

Frontenac AC is part of this much larger white nationalist movement.

“White nationalism in Canada is increasingly organized and cohesive, with (active clubs) playing a significant part,” Simons said.

The movement has tendrils that extend across Canada.

Take, for example, the secretive neo-Nazi conference held in Vancouver in July. The Canadian Anti-Hate Network and CBC News teamed up for an investigation published in November, exposing attendees of this “Exiles of the Golden Age” event.

Three of the attendees photographed wore the uniform of Second Sons Canada, one of the active clubs that make up a militant arm of what anti-hate researchers have dubbed “the largest white nationalist (movement) in Canadian history.” Its founder, Jeremy MacKenzie — who also founded the far-right group Diagolon — has been filmed just this year making a Hitler salute on Telegram.

Second Sons Canada recently announced that it was pleased to “formally welcome” Frontenac AC “to the organization.”

Who are the public-facing members of these groups?

Most of the men in Frontenac AC’s propaganda images have their faces blurred. Just two of them were willing to associate themselves with this group’s ideologies and actions.

One of those two individuals is the vice-president of Second Sons Canada, Alex Vriend. That’s nothing new. Frontenac AC and Second Sons Canada have demonstrated together, trained together and posed for many photos together.

Vriend is featured in multiple propaganda images taken at Alpha Athletika, wearing a T-shirt emblazoned with the logo for Second Sons Canada.

Alex Vriend, the vice-president of a white nationalist group called Second Sons Canada, can be seen in the top photo second from right. In the bottom photo, Vriend is the tall, bald man whose face is not blurred. Both photos were taken inside Alpha Athletika.

Photos via Telegram.

Vriend is a virulent racist and militant white nationalist. He regularly hosts livestreams as part of the Diagolon community, where he spews all kinds of hateful rhetoric and has even broadcast footage of people from India being killed by trains — while laughing.

In 2024, he told livestream viewers they’ve got to harden up.

“If hearing people talk in a very aggressive and offensive way is too much for you, are you really gonna be able to stomach like men, women and children being loaded onto fucking boats at gunpoint so they can be sent back to India?” he asked, according to a Canadian Anti-Hate Network report. The Tyee has independently verified the quote.

“Like if the word, you know, ‘n****r’ is obviously like the most offensive one, if that is too much for you, I seriously doubt your ability to have the intestinal fortitude to stomach what needs to happen because what needs to happen is very aggressive and extreme.”

Standing alongside Vriend at the gym is the only other active club member willingly to show his face, Shawn Beauvais-MacDonald.

Beauvais-MacDonald made headlines in Canada after he was unmasked as an attendee of the Unite the Right rally in Charlottesville in 2017. That’s the infamous event where tiki torch-wielding protesters chanted “Jews will not replace us” and where counter-protester Heather Heyer was killed in a car ramming attack.

Beauvais-MacDonald was a bit more coy about his views at the time, telling Vice Canada in 2017 that he didn’t consider himself a white supremacist but is “proud of being white” and didn’t “know enough about (the KKK and neo-Nazis) to comment” on whether he sympathizes with them.

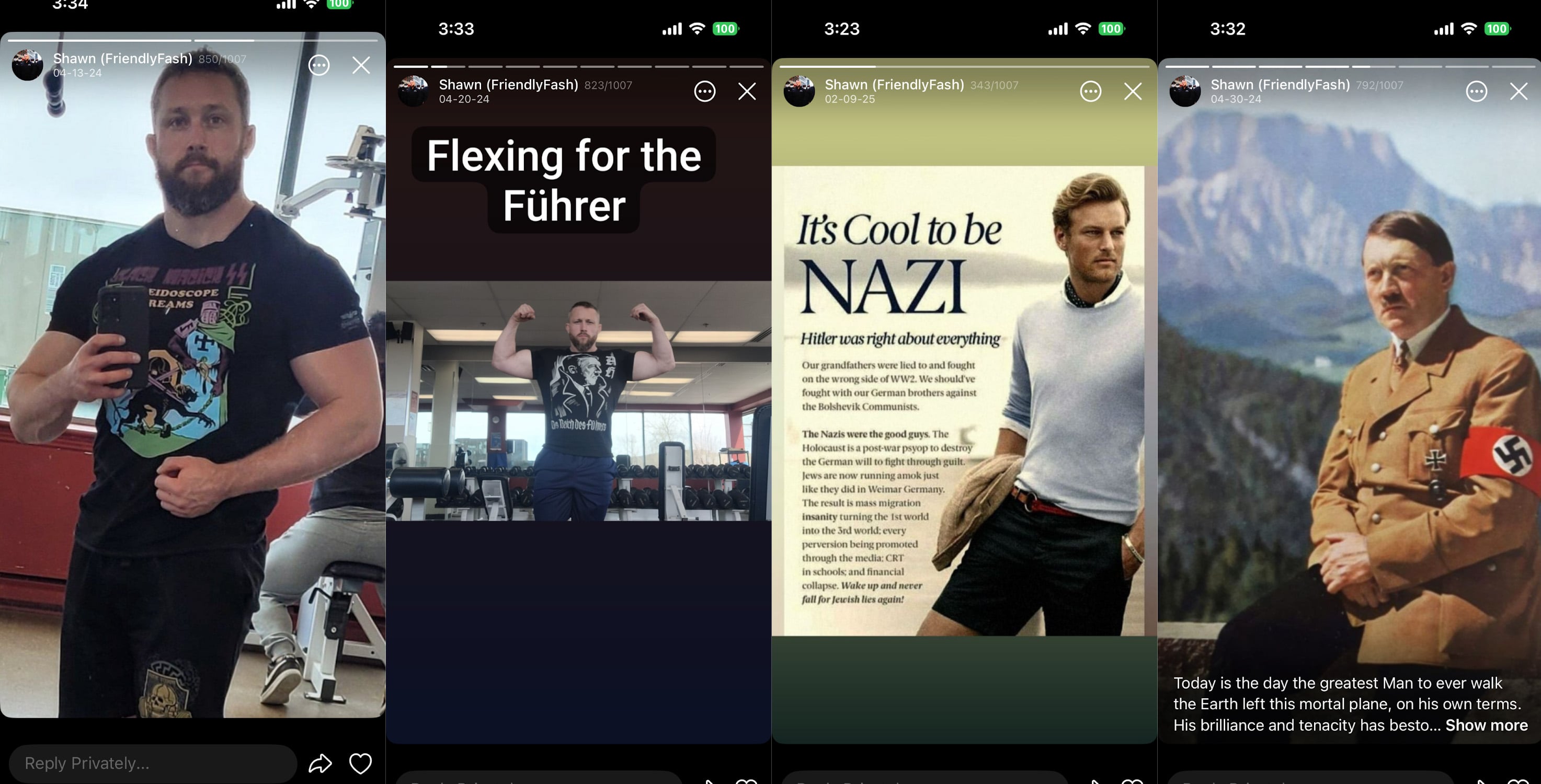

Nowadays, however, he’s abandoned any semblance of shame about his neo-Nazism.

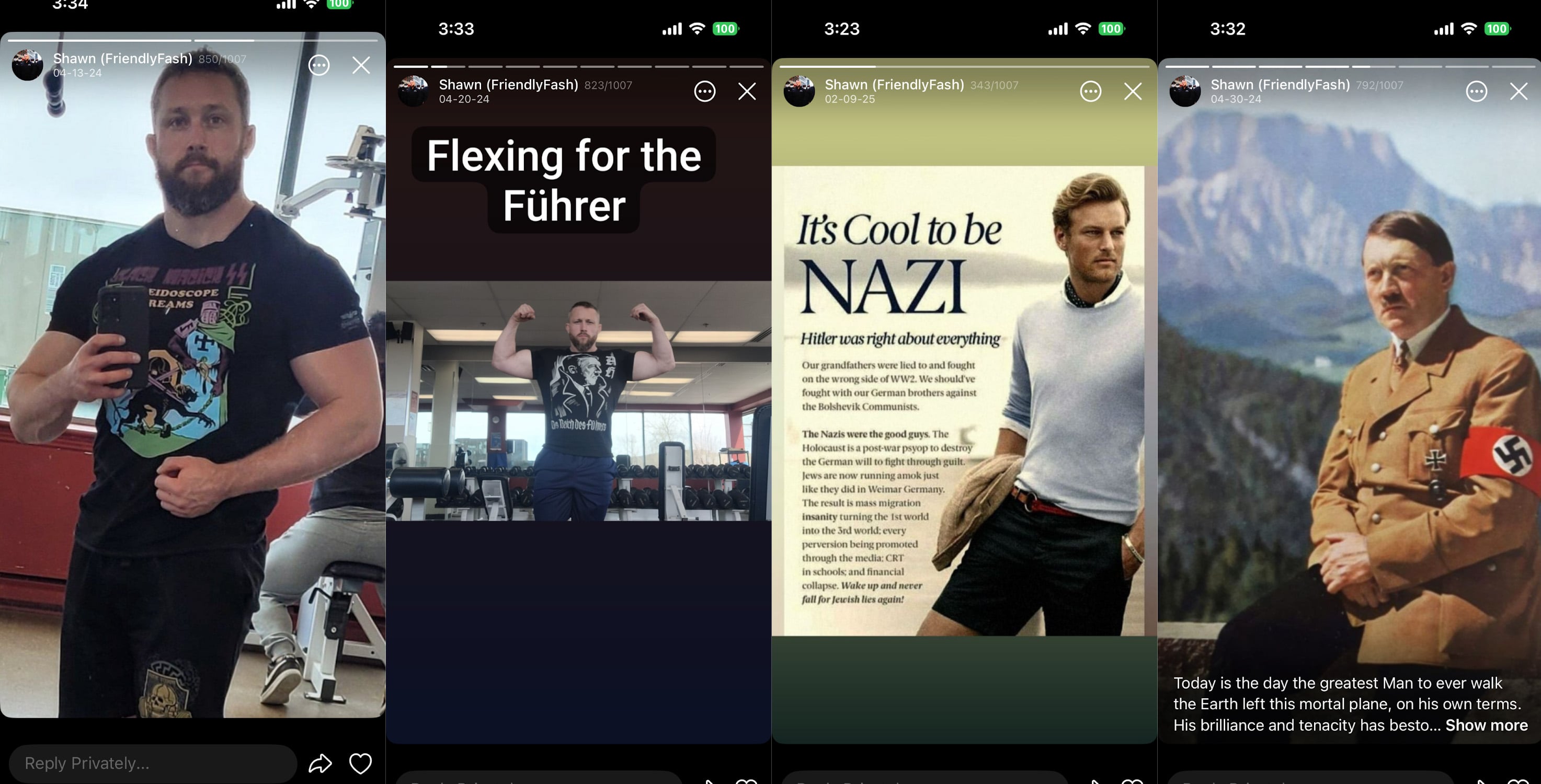

According to images The Tyee obtained from his Telegram account, Beauvais-MacDonald has posted stories lauding Adolph Hitler, images announcing it’s “cool to be Nazi” and adding that “Hitler was right about everything.” He can be seen in videos giving a Nazi salute and yelling “Heil Hitler.” He is loud and proud about his hateful views, regularly posting videos from public places in T-shirts adorned with images of Hitler and other Nazi-era imagery.

Images from Shawn Beauvais-MacDonald’s Telegram account show him celebrating Hitler and being ‘Nazi.’

Images via Telegram.

Posts advertising the Frontenac Active Club on Telegram tell potential members to contact FriendlyFash — Beauvais-MacDonald’s Telegram username — to get involved.

Uncovering the gym in Frontenac Active Club photos

It all started with a tip from a government source.

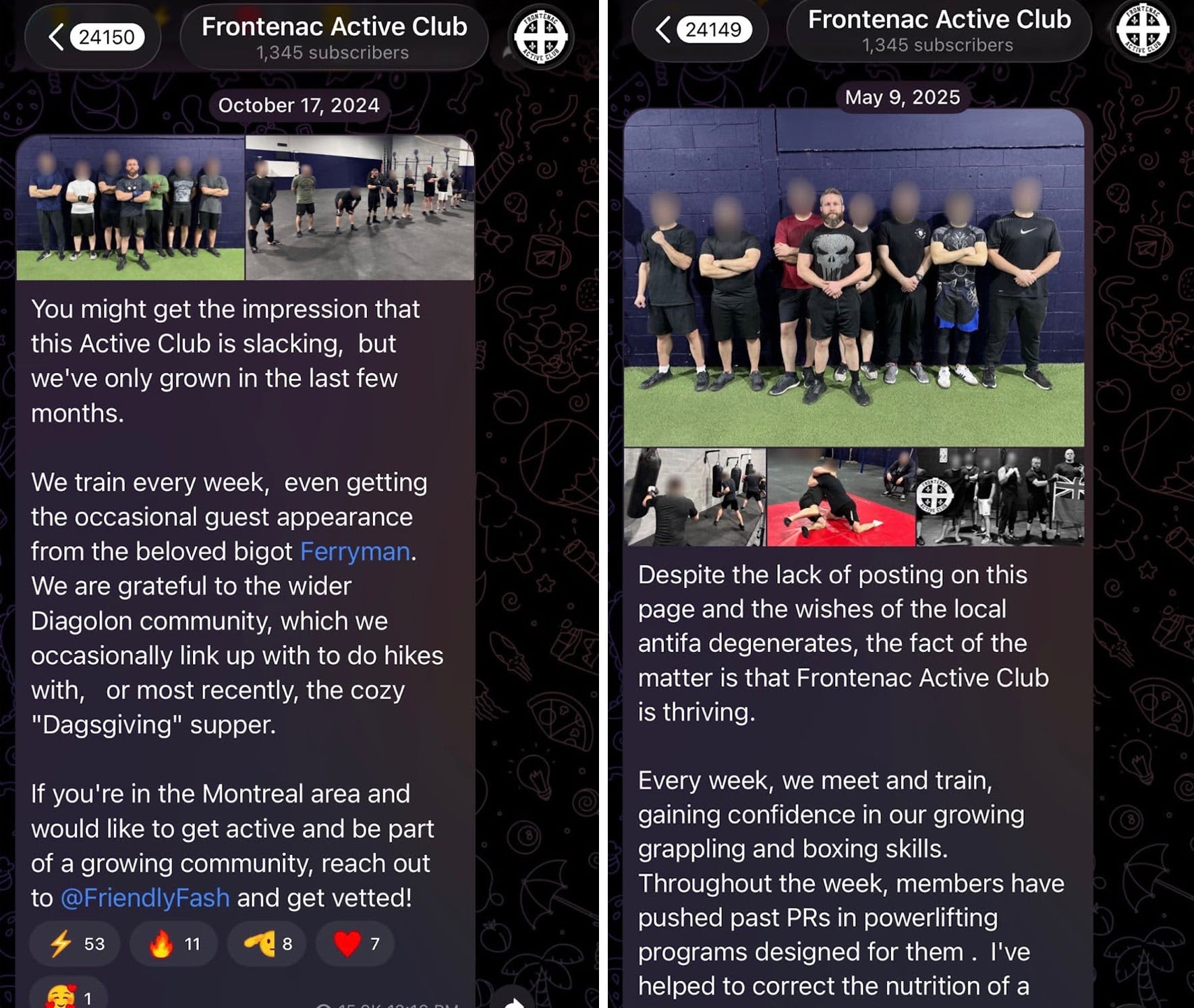

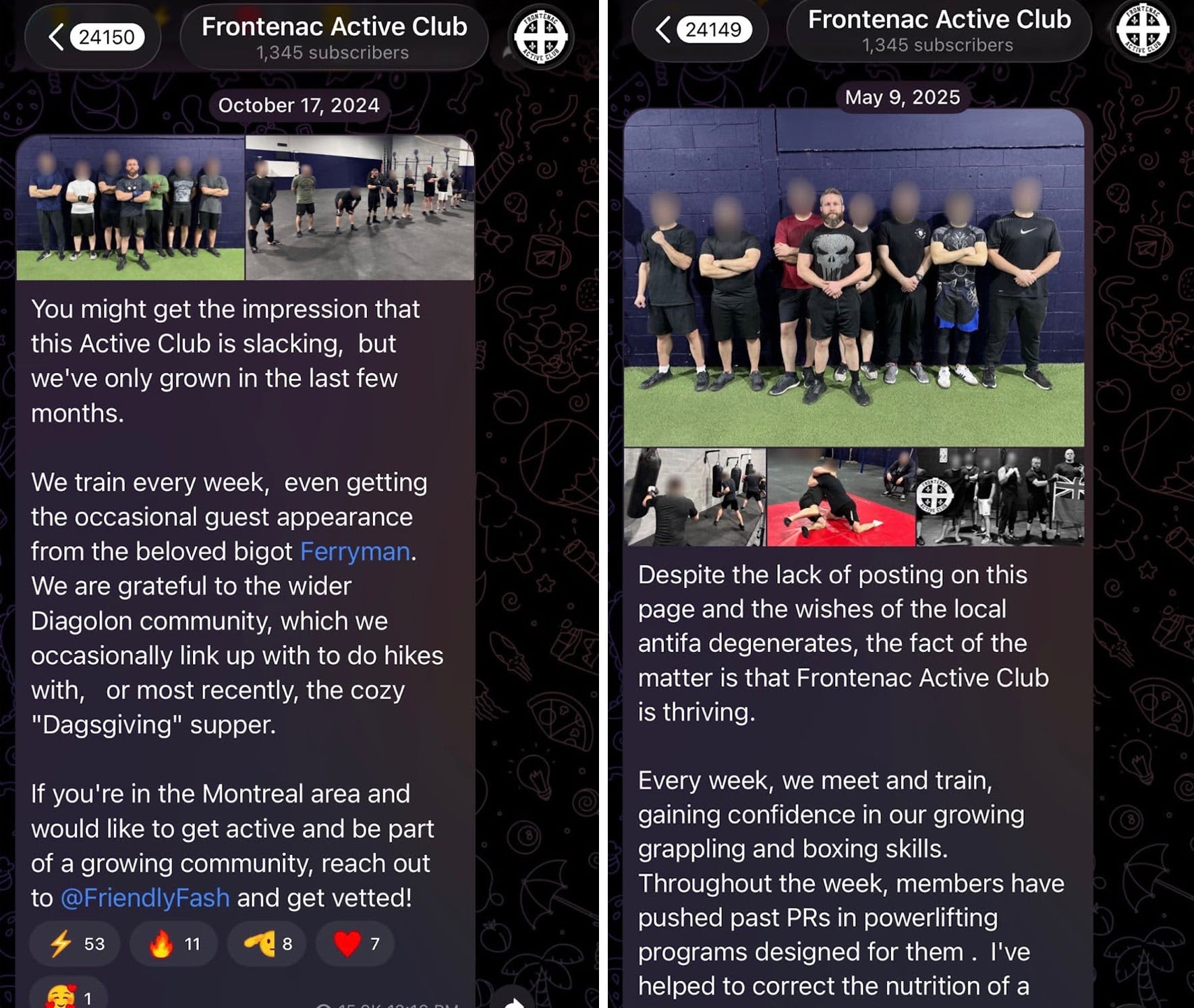

Frontenac Active Club had posted images on two separate occasions from a gym with some distinctive features: once in October 2024, and another time in May 2025.

Posts from the Frontenac Active Club Telegram account show photos of members training inside the gym along with text encouraging new members to join the group.

Images via Telegram.

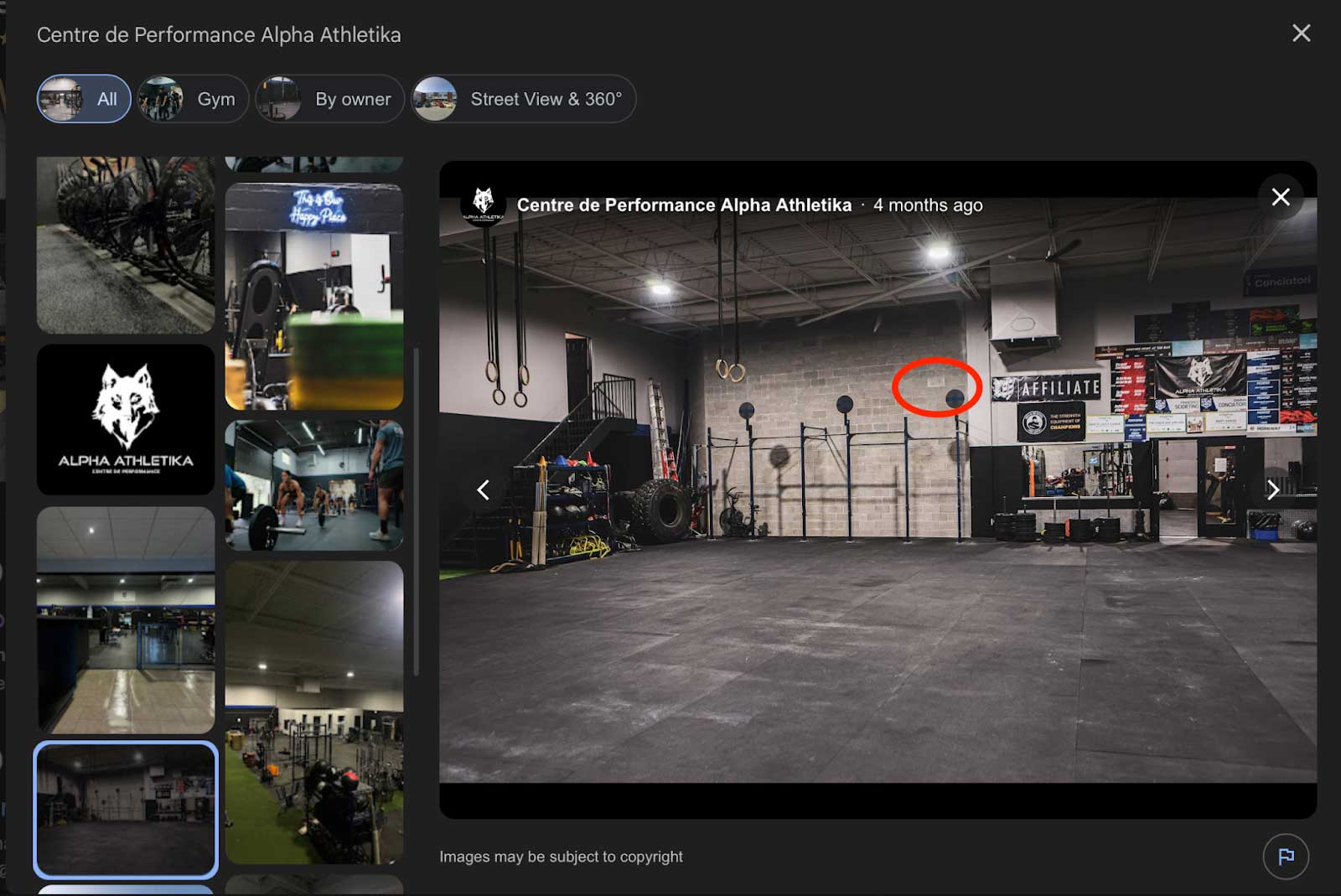

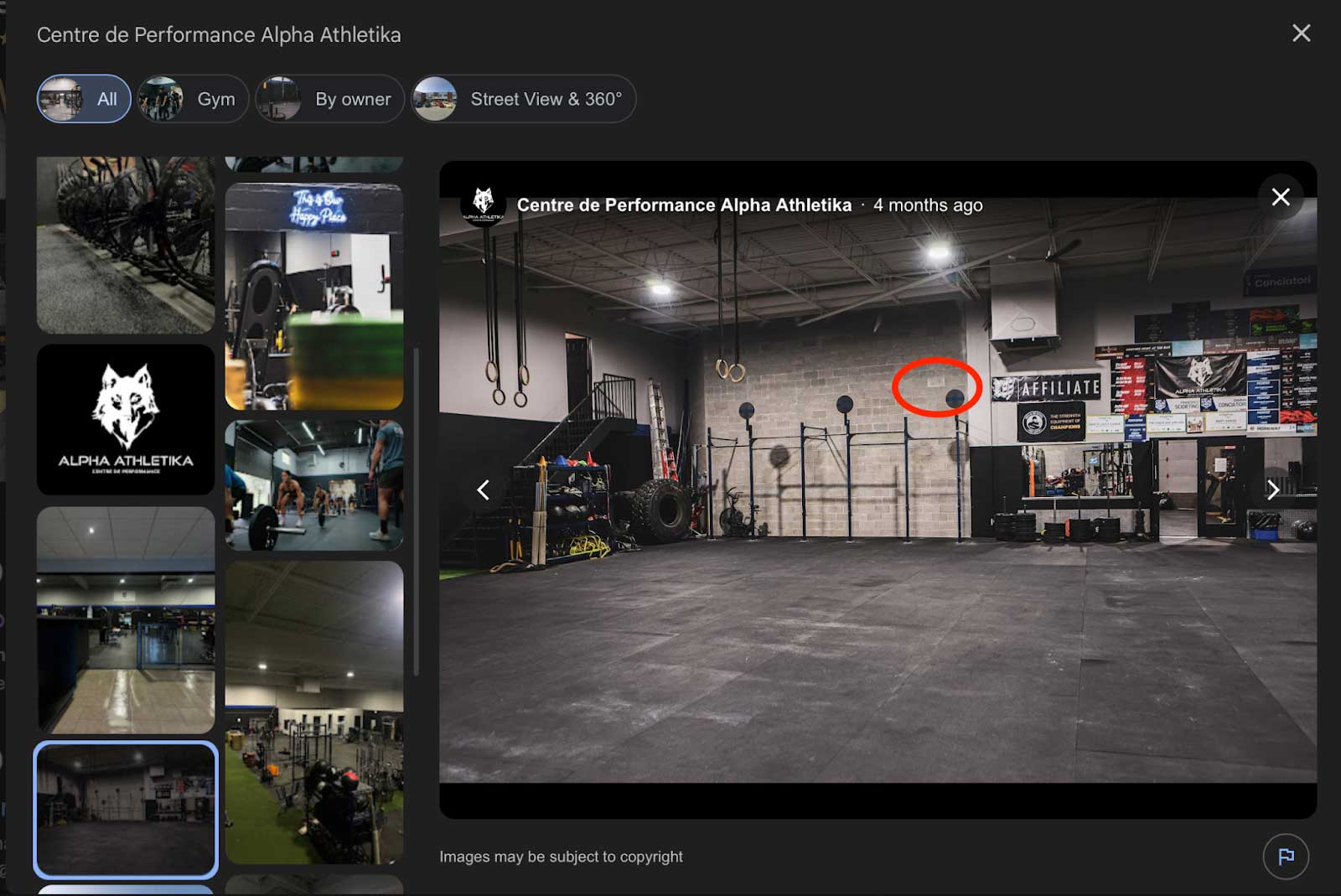

Through comparing photos of the gym interior from Google with the Telegram posts from Frontenac AC, the Tyee confirmed the photos were taken inside Alpha Athletika.

While it appears Frontenac AC took steps to try to hide identifying features of the gym, they didn’t catch them all. For example, in one image, you can see the same flooring, same metal structures and same piles of weights.

One last element would have been an overwhelming coincidence: the same discoloured brick, on the same grey brick wall, is seen in both the gym’s Google image results and the Frontenac AC propaganda photos.

To identify the gym where Frontenac Active Club took their training photos, The Tyee identified key identifying features, such as these metal structures we’ve circled in red.

Top image via Google search; bottom image via Telegram.

In another photo posted to the Frontenac AC Telegram channel, the group — including Beauvais-MacDonald and Vriend — are seen posing with a massive Frontenac AC flag as well as a Red Ensign flag.

Beauvais-MacDonald is wearing shorts printed with a totenkopf, which is a symbol Hitler’s SS adopted during the Nazi era, and a T-shirt with the logo for Will2Rise, a brand Rolling Stone said “wants to be Lululemon for fascists.” Vriend is wearing his Second Sons Canada shirt.

In short, they aren’t hiding who they are.

Another comparison of publicly available photos of the gym interior and photos from the Frontenac Active Club’s Telegram account showed a similar wooden peg board.

Left image via Google search; right image via Telegram.

This photo provided further confirmation that the group was at Alpha Athletika. The same wooden board is seen on the walls in both the Frontenac AC photo and on the gym’s Google page. The images feature several other similarities, including the metal equipment seen in both, as well as some ropes, rings and the flooring.

But the most damning similarity can be seen in two imperfections in the brick wall — the exact same arrangement of two holes just below the wooden peg board, to the left.

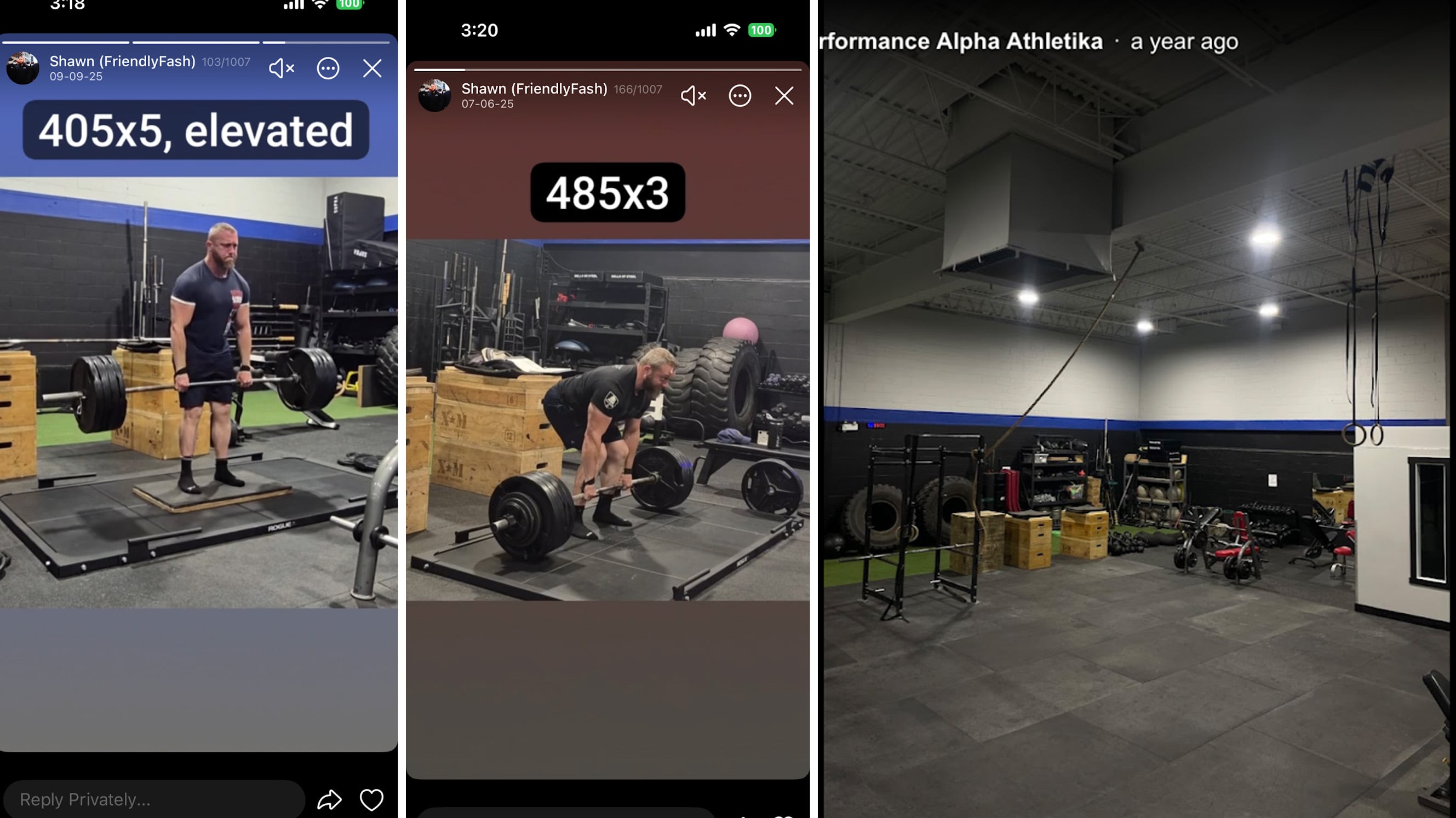

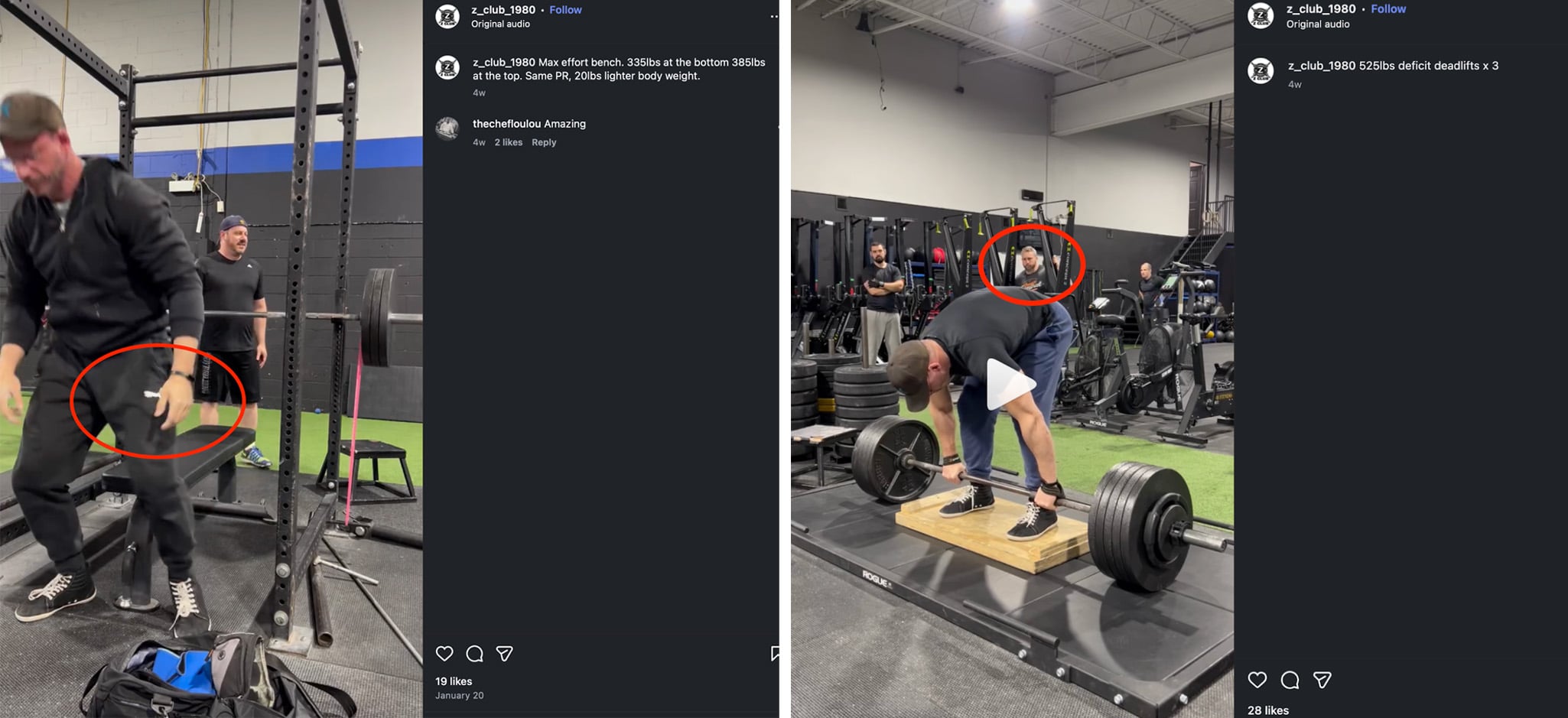

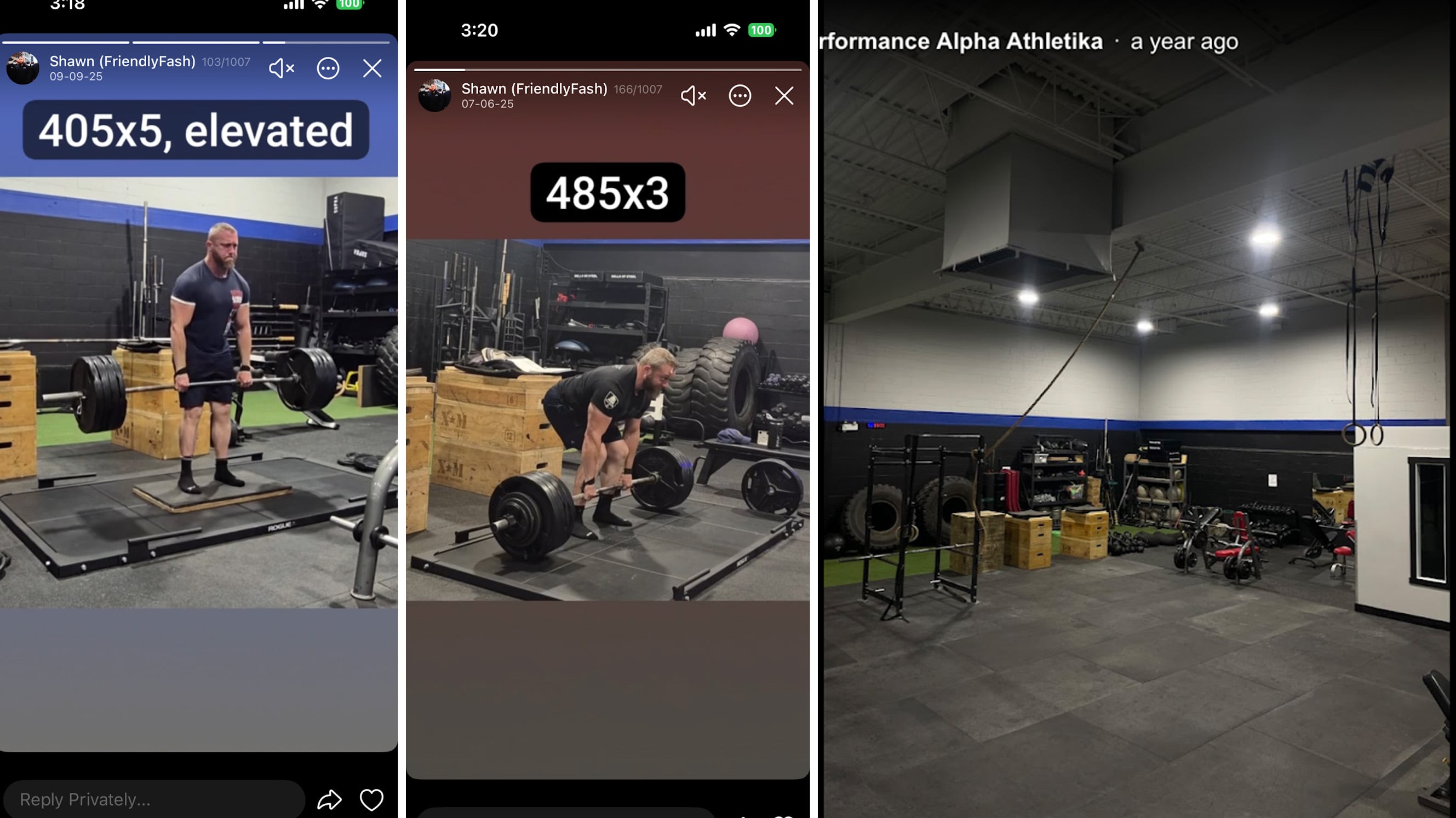

On top of the images Frontenac AC posted, Beauvais-MacDonald had shared even more images of himself at Alpha Athletika.

Beauvais-MacDonald is wearing different shirts in the images, suggesting he’s been to the gym on at least two separate occasions.

Shawn Beauvais-MacDonald posted numerous photos of himself training at the gym, showing stacked wooden boxes that match publicly-available photographs of the gym’s interior.

Left and centre image via Telegram; right image via Google search.

These similarities, combined with the tip from the government source, make it crystal clear: Alpha Athletika is the gym where Frontenac AC both trained and took these images, which they then shared to their social media as propaganda with the aim of advertising their organization and attracting new recruits.

The Tyee shared these photos with the gym’s owner, who did not dispute they showed the interior of Alpha Athletika.

But how did this active club manage to take these kinds of photos while apparently keeping the ownership of Alpha Athletika, who told The Tyee they care deeply about having a welcoming community at their gym, entirely in the dark?

The answer appears to lie with a man who was unmasked as part of this investigation.

The former Olympian

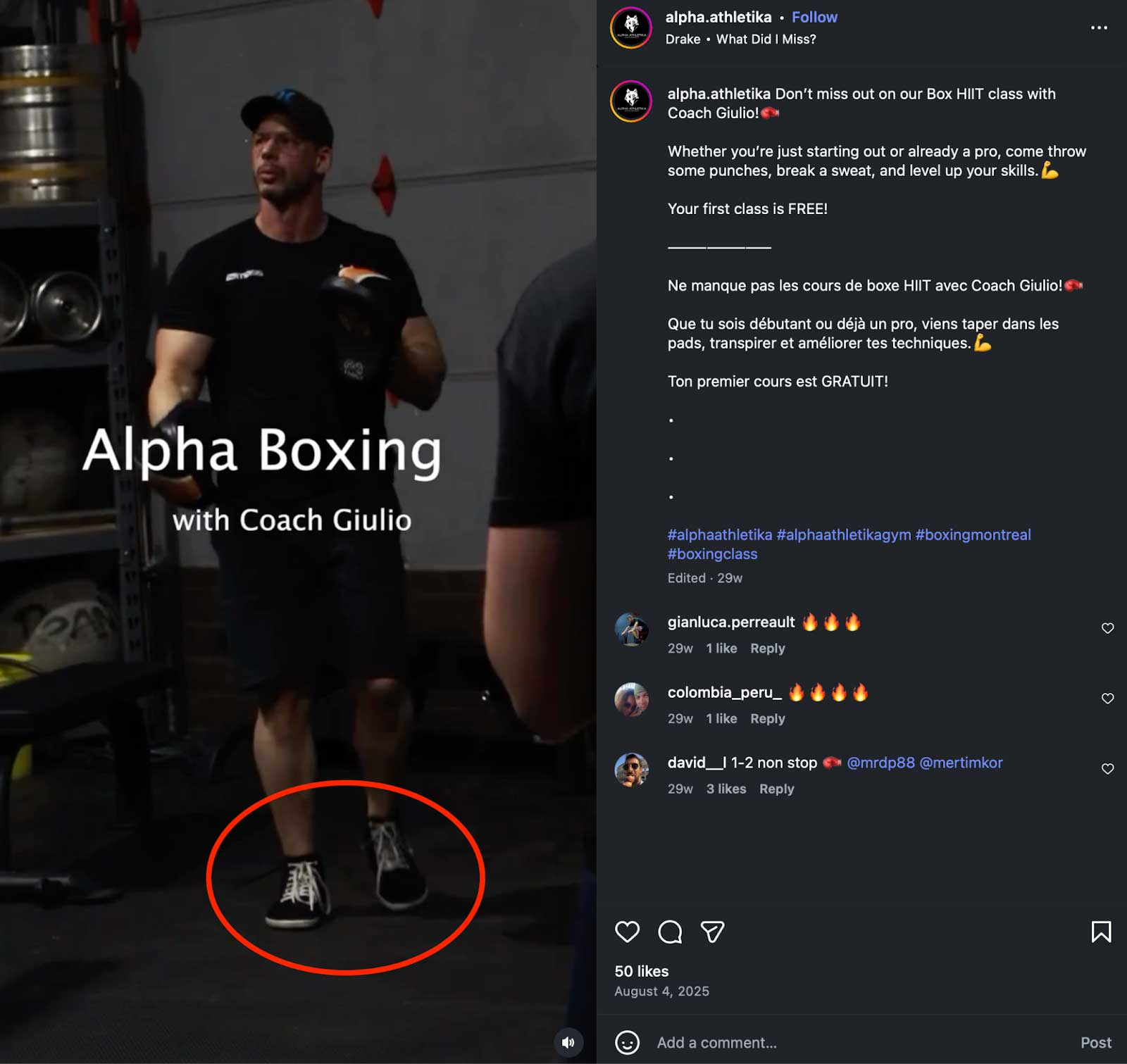

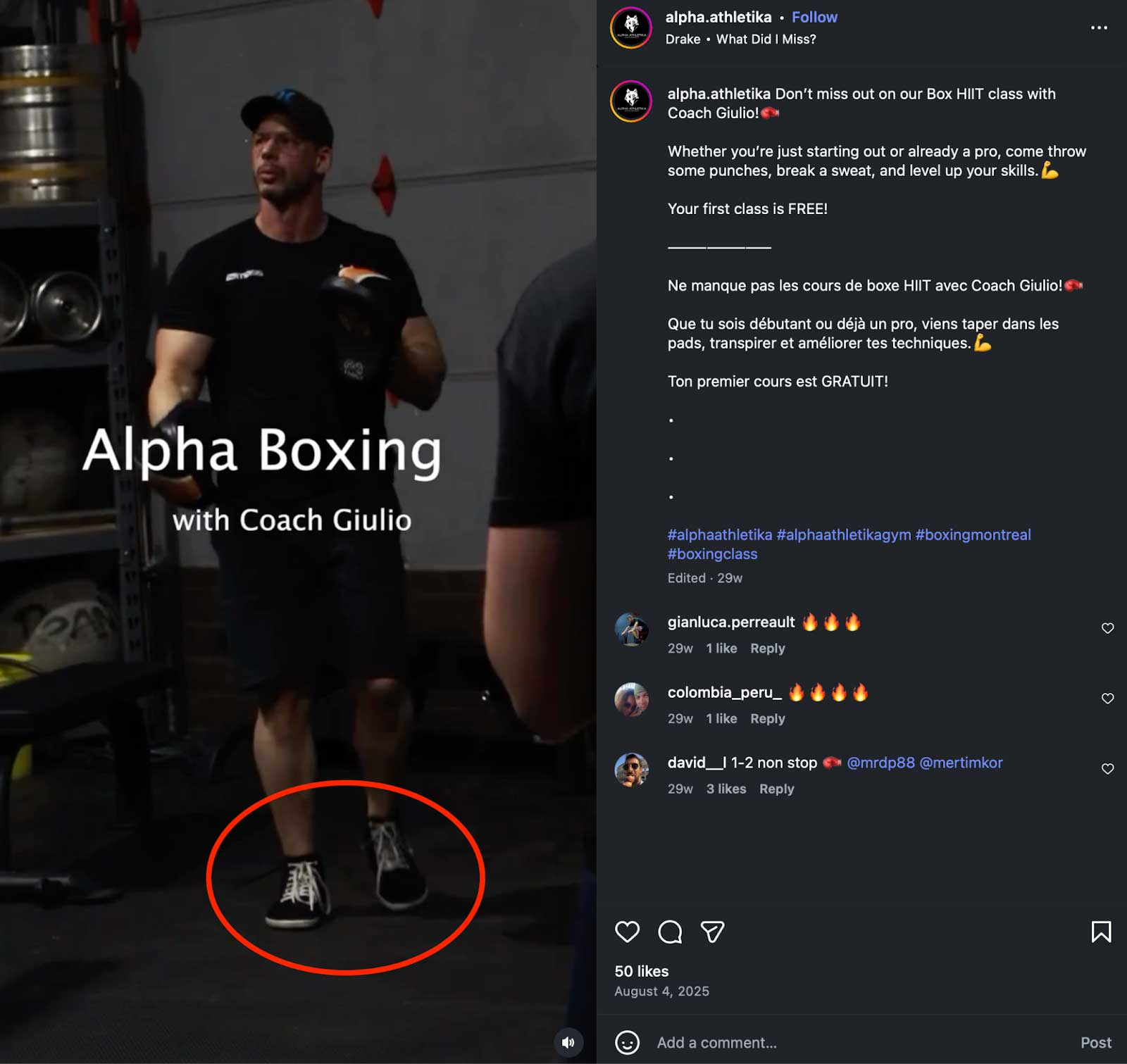

Simons, the extremism researcher with the Canadian Anti-Hate Network, noticed something in images shared with her and in her related searches online. A boxing coach that Alpha Athletika promoted — “classes with ‘Coach Giulio’” — had shoes that matched those seen in one of the Frontenac AC images.

An Instagram post for the Alpha Athletika gym advertises ‘classes with Coach Giulio.’

Image via Instagram.

In a photo of the Frontenac Active Club training at the gym, The Tyee identified a man whose face was blurred, but who was wearing the same style of shoes as ‘Coach Giulio.’

Image via Telegram.

Another photo from the Frontenac Active Club shows a man with the same style of shoes seen in the previous two photographs.

Image via Telegram.

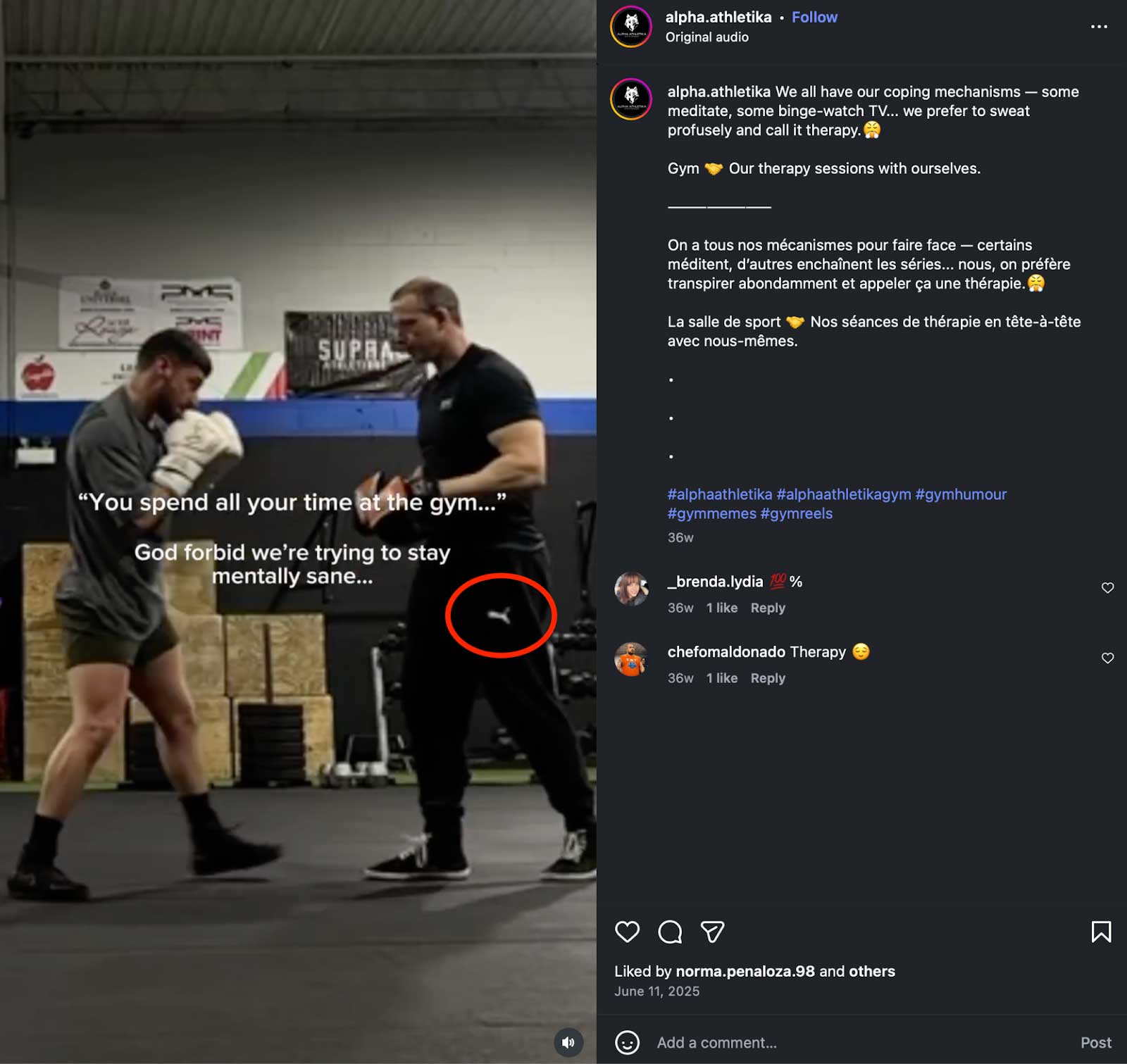

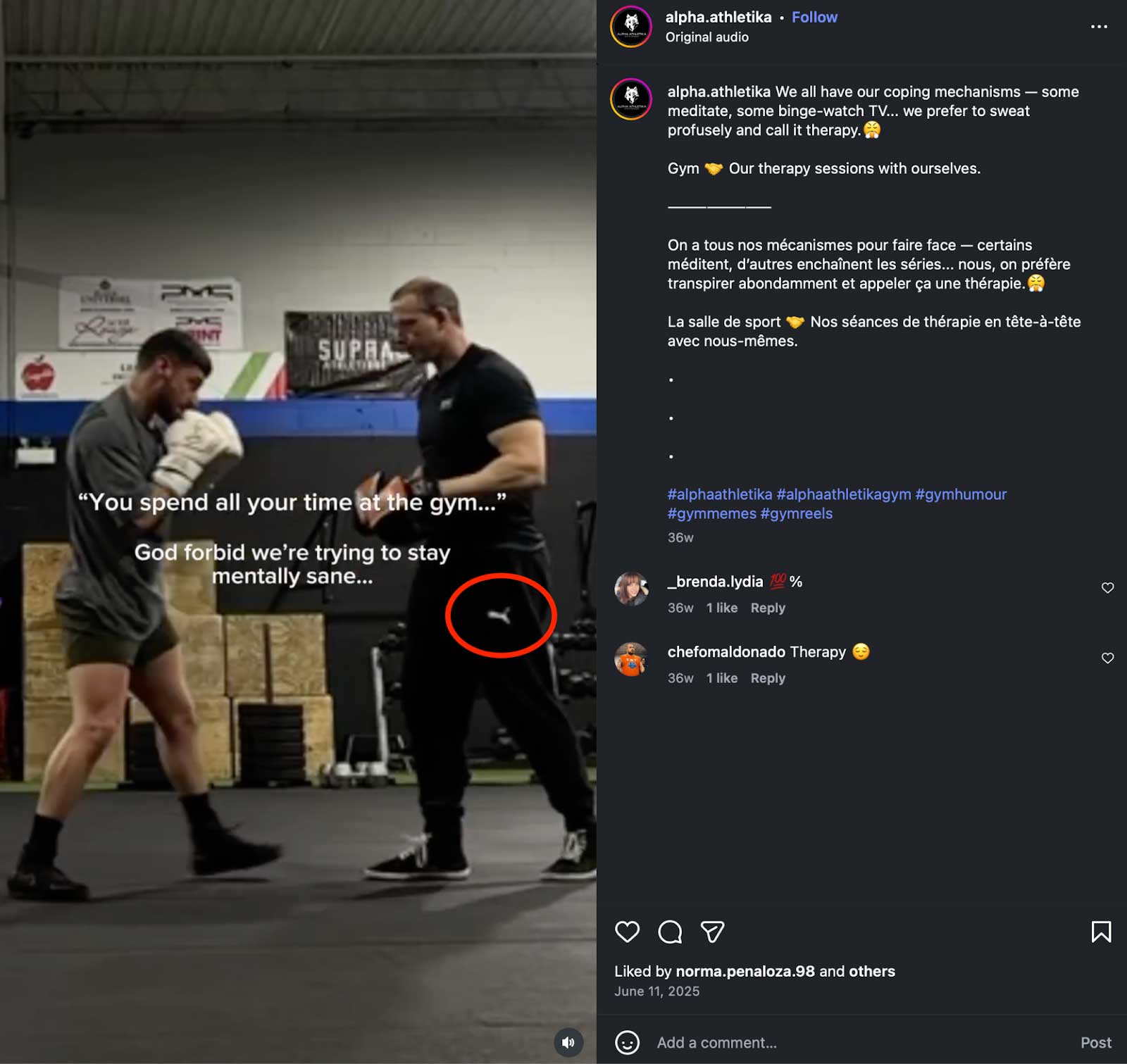

It didn’t take long for the Tyee to find images of “Coach Giulio” wearing the same Puma athletic pants that are visible in the Frontenac AC image.

In addition to matching the shoes in these photographs, The Tyee identified a man wearing the same Puma athletic pants in several photos from the Frontenac Active Club Telegram account and Alpha Athletika’s Instagram account.

Top photo via Telegram; bottom photo via Instagram.

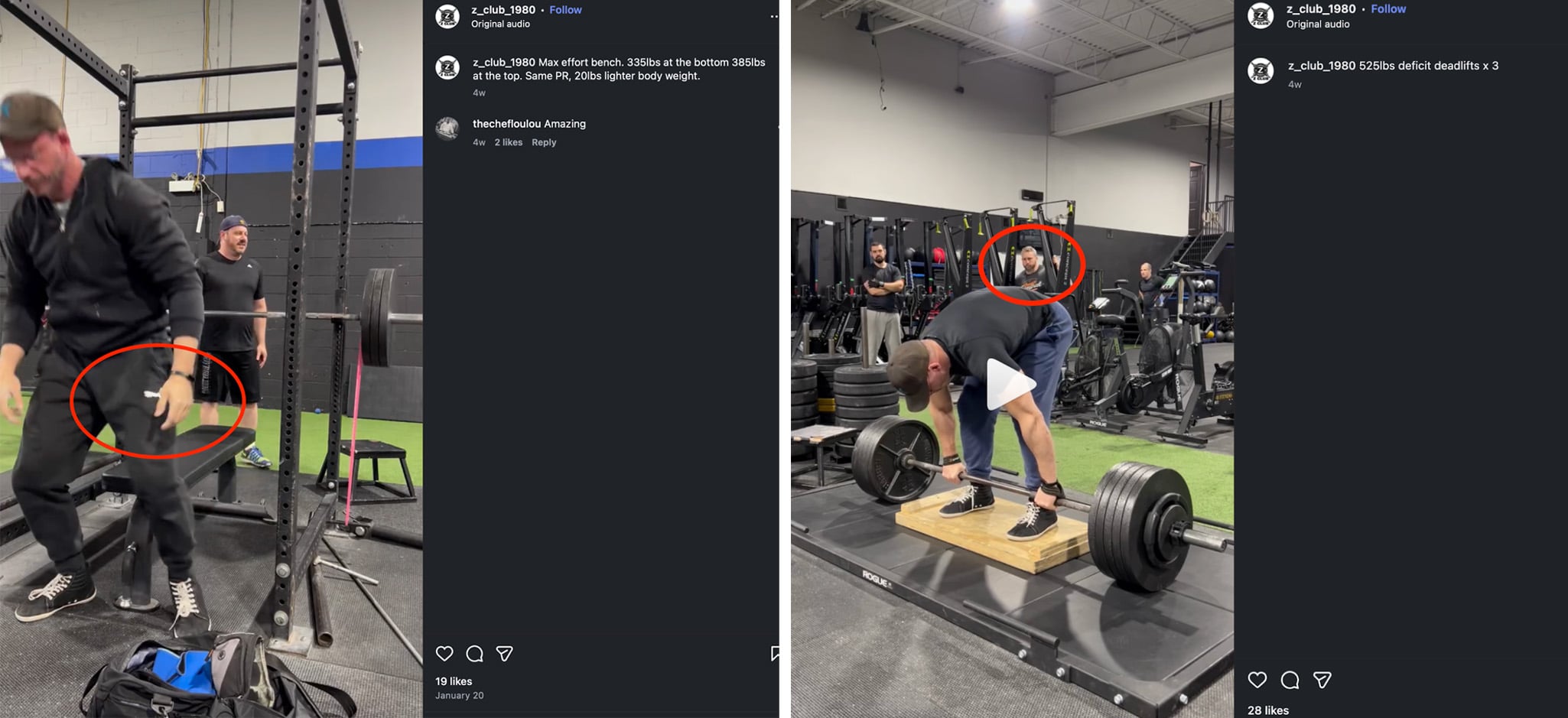

As we continued looking into him, Simons spotted someone in the background of a video “Coach Giulio” posted from the gym: a man who appears to be Shawn Beauvais-MacDonald.

Posts from Giulio Zardo’s Instagram account show him training at Alpha Athletika. In the photo on the left, a man who appears to be Shawn Beauvais-MacDonald can be seen in the background.

Photos via Instagram.

Coach Giulio’s full name is Giulio Zardo. He is a 45-year-old man from Montreal who represented Canada as part of the Olympic bobsledding team in Salt Lake City in 2004.

Researchers at Montreal Antifasciste, a local anti-fascist group dedicated to unmasking far-right extremists in their community, told me they were familiar with the name. In fact, they had previously published that Zardo had allegedly trained a previous far-right group, Atalante. Atalante made headlines in 2018 after it stormed VICE offices in Montreal.

The Tyee tried to get in touch with Zardo through his Instagram account and also asked Alpha Athletika to forward our request on to Zardo. He did not respond.

Naming names is about community safety, says extremism researcher

In recent months, several journalists have taken up work that’s often more common on anti-fascist blogs: the work of identifying and exposing individuals with neo-Nazi or far-right ideologies.

CBC News and the Canadian Anti-Hate Network have published several of these names.

In November 2025, CBC published a story that named people who had attended a white nationalist event in Vancouver. After the story came out, the wider community reacted: a gym owned by one of the attendees released a statement saying his attendance had been a mistake; a South Asian MMA fighter spoke out against the presence of white nationalist groups in his sport; and the manager of the Prince George symphony left her job after being identified as one of the attendees at the event.

For Simons, unmasking individuals associated with these hateful ideologies and groups is a part of ensuring your neighbourhood stays safe.

“Communities deserve to know who in their neighbourhood is a fascist,” she said.

“Especially when those fascists are organizing or attempting to take over community third spaces like gyms.” ![[Tyee]](https://thetyee.ca/design-article.thetyee.ca/ui/img/yellowblob.png)

![]() CHS has obtained the Police Traffic Collision Report for the deadly February collision at Pine and Bellevue and can report new details of what the Seattle Police Department’s preliminary investigation of the tragedy revealed.

CHS has obtained the Police Traffic Collision Report for the deadly February collision at Pine and Bellevue and can report new details of what the Seattle Police Department’s preliminary investigation of the tragedy revealed. $5 A MONTH TO HELP KEEP CHS PAYWALL-FREE

$5 A MONTH TO HELP KEEP CHS PAYWALL-FREE

Photos from Frontenac Active Club’s Telegram channel show members of the group training inside a gym The Tyee has identified as Alpha Athletika in Montreal.

Photos from Frontenac Active Club’s Telegram channel show members of the group training inside a gym The Tyee has identified as Alpha Athletika in Montreal.

Alex Vriend, the vice-president of a white nationalist group called Second Sons Canada, can be seen in the top photo second from right. In the bottom photo, Vriend is the tall, bald man whose face is not blurred. Both photos were taken inside Alpha Athletika.

Alex Vriend, the vice-president of a white nationalist group called Second Sons Canada, can be seen in the top photo second from right. In the bottom photo, Vriend is the tall, bald man whose face is not blurred. Both photos were taken inside Alpha Athletika.

Images from Shawn Beauvais-MacDonald’s Telegram account show him celebrating Hitler and being ‘Nazi.’

Images from Shawn Beauvais-MacDonald’s Telegram account show him celebrating Hitler and being ‘Nazi.’

Posts from the Frontenac Active Club Telegram account show photos of members training inside the gym along with text encouraging new members to join the group.

Posts from the Frontenac Active Club Telegram account show photos of members training inside the gym along with text encouraging new members to join the group.

To identify the gym where Frontenac Active Club took their training photos, The Tyee identified key identifying features, such as these metal structures we’ve circled in red.

To identify the gym where Frontenac Active Club took their training photos, The Tyee identified key identifying features, such as these metal structures we’ve circled in red.

Another comparison of publicly available photos of the gym interior and photos from the Frontenac Active Club’s Telegram account showed a similar wooden peg board.

Another comparison of publicly available photos of the gym interior and photos from the Frontenac Active Club’s Telegram account showed a similar wooden peg board.

Shawn Beauvais-MacDonald posted numerous photos of himself training at the gym, showing stacked wooden boxes that match publicly-available photographs of the gym’s interior.

Shawn Beauvais-MacDonald posted numerous photos of himself training at the gym, showing stacked wooden boxes that match publicly-available photographs of the gym’s interior.

An Instagram post for the Alpha Athletika gym advertises ‘classes with Coach Giulio.’

An Instagram post for the Alpha Athletika gym advertises ‘classes with Coach Giulio.’

In a photo of the Frontenac Active Club training at the gym, The Tyee identified a man whose face was blurred, but who was wearing the same style of shoes as ‘Coach Giulio.’

In a photo of the Frontenac Active Club training at the gym, The Tyee identified a man whose face was blurred, but who was wearing the same style of shoes as ‘Coach Giulio.’

Another photo from the Frontenac Active Club shows a man with the same style of shoes seen in the previous two photographs.

Another photo from the Frontenac Active Club shows a man with the same style of shoes seen in the previous two photographs.

In addition to matching the shoes in these photographs, The Tyee identified a man wearing the same Puma athletic pants in several photos from the Frontenac Active Club Telegram account and Alpha Athletika’s Instagram account.

In addition to matching the shoes in these photographs, The Tyee identified a man wearing the same Puma athletic pants in several photos from the Frontenac Active Club Telegram account and Alpha Athletika’s Instagram account.

Posts from Giulio Zardo’s Instagram account show him training at Alpha Athletika. In the photo on the left, a man who appears to be Shawn Beauvais-MacDonald can be seen in the background.

Posts from Giulio Zardo’s Instagram account show him training at Alpha Athletika. In the photo on the left, a man who appears to be Shawn Beauvais-MacDonald can be seen in the background.

![[Tyee]](https://thetyee.ca/design-article.thetyee.ca/ui/img/yellowblob.png)